Bonds and Eurobonds

A bond is a debt security that the issuer (government, public company) undertakes to redeem on the agreed date and to pay a coupon (interest) on it. Basically, buying a bond is a loan from a company or government.

The bondholder’s income is coupon payments (interest on the debt) and the rise in the bond’s price.

Bonds differ in yield, coupon types and maturities.

Profitability

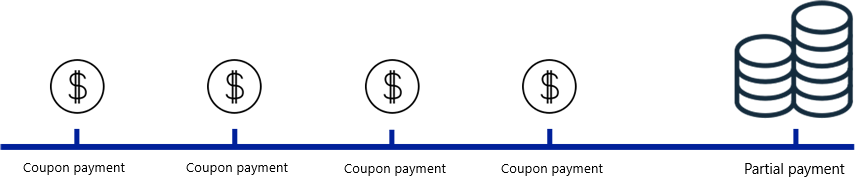

If you bought a bond, you will receive periodic payments on it – “coupons”, and you can either sell it on the market (at a higher or lower price than the purchase price) or hold it until maturity.

At the time of maturity, you will receive the par value of the bond – this is a constant value that you can look at before buying the bond in order to understand whether you will be returned more or less than you invested in the bond. If you buy at a price below par, you will receive additional profits at maturity.

The yield depends on the market price of the bond, which, in turn, depends on the riskiness of the issuer. For example, if a company is on the verge of bankruptcy, its bonds are likely to be cheap and give high yields.

Also, the bond yield is influenced by the country of registration of the issuer (country risk), as well as the bond nomination currency (bonds in relatively reliable currencies give less income).

Coupons

Coupons are alike the interest on a bank deposit. They are credited to the account on predetermined dates, usually once every six months or a year.

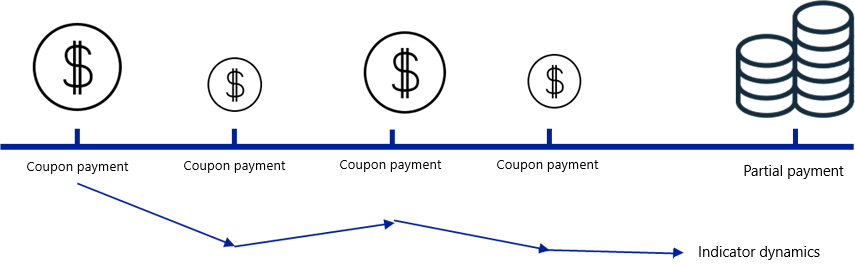

Coupons are either permanent or variable.

Permanent coupon – the same payment on a bond until it is redeemed.

The size of coupon payments can change – then such bonds have a “variable coupon”: the formula for calculating the size of the payment contains one or several unknowns.

They can be the refinancing rate of the Central Bank, the consumer price index, the dollar exchange rate, etc. For example, if the coupon is tied to the Central Bank rate and the rate rises, coupon payments will grow, and vice versa.

Maturity dates

Bonds with different maturities are circulating on the market – both six months and tens of years (there are also perpetual bonds – endless). To compare bonds by maturity, a parameter such as bond duration is used.

Duration is the weighted average time of receipt of the coupon and face value. Duration is needed to compare bonds with each other in terms of maturity. The further the payment, the less its weight. A long-duration bond is usually a long-term bond.

Eurobonds and Bonds – Currency Difference

On the market, you will come across the concept of Eurobonds – these are the same bonds, but denominated in foreign currency. They usually have lower profitability, but this is a way to invest dollar savings.

The projected income with an understandable risk is bonds and Eurobonds.

EN

EN

RU

RU